The most internationally used standard for measuring and reporting greenhouse emissions is the GHG protocol (Greenhouse Gas Protocol), where emissions are divided into three different categories: scope 1, scope 2 and scope 3.

When reporting on the climate impacts of business operations, it is customary to classify emissions into scope 1, 2 and 3 categories in accordance with the GHG protocol. Classification of emissions reduces the risk of double counting between emission calculations of different companies and helps the company and the company’s stakeholders to understand the most significant emission sources of the company’s business in its own and value chain operations.

Many companies also report value chain emissions in more detail, broken down into fifteen different emission categories. By utilizing emission data, the company is able to identify the most relevant emission sources for its operations and optimize its business to reduce the burden on the environment.

Greenhouse gas emissions caused by the company’s operations, such as carbon dioxide (CO2), methane (CH4) and nitrogen oxide (N2O) emissions, are a significant environmental aspect related to the business.

Growing reporting obligations, such as the CSRD sustainability reporting directive, now and in the future require companies to report in detail the environmental impacts of their business operations

Scope 1, scope 2 and scope 3 classification

In accordance with the Greenhouse Gas protocol, emissions are classified as follows:

- Scope 1 includes all direct greenhouse emissions that are formed as a result of the company’s operations

- Scope 2 includes greenhouse emissions caused by the production of purchased and consumed energy

- Scope 3 includes all other indirect greenhouse emissions that are formed as a result of the company’s operations, but the emission sources themselves are not owned or controlled by the company. Such emission sources include, for example, emissions from the primary production of purchases and emissions caused by travel and transport. Scope 3 emissions are broken down into fifteen different emission categories.

Scope 1: direct greenhouse emissions

Scope 1 emissions consist of direct emissions from resources owned or controlled by the company. Emissions are created as a direct result of the company’s operations, and these emission sources are typically the easiest to control.

Scope 1 emissions can be divided into four groups:

Process emissions

Process emissions refer to direct greenhouse gas emissions, such as methane emissions from anaerobic fermentation or natural gas flaring, generated in the company’s operations.

Own energy production

If the company produces operational energy either for its own use or that of other operators, the emissions resulting from energy production are included in the scope 1 emissions of the reporting company.

Fuel consumption

Emissions caused by fuel consumption in machines, equipment and vehicles owned or managed by the company.

Fugitive emissions

Fugitive emissions are so-called leak emissions, which are caused, for example, as a result of pipe and equipment leaks. They occur not only in industry but also in ordinary home and office conditions, such as, for example, malfunctioning refrigerators and air conditioners. These emissions can be reduced or completely avoided by taking care of the equipment’s condition and maintenance appropriately and by repairing or replacing malfunctioning equipment.

Scope 1 emissions therefore include greenhouse gas emissions directly caused by the company’s own operations. Since Scope 1 emissions are generated as a result of the company’s own operations, it is also the easiest to influence them.

Scope 2: indirect greenhouse emissions of energy consumption

Scope 2 emissions include all greenhouse gas emissions that arise from the production of energy purchased from another party. This includes emissions from the production of purchased electricity, heat, steam or cooling.

Electricity and heat purchased for most companies are the main sources of scope 2 emissions. However, it should be noted that for some companies, the separate procurement of steam and cooling can also cause scope 2 emissions. On the other hand, if the company produces some or all of its own energy, the emissions from production are taken into account as part of the calculation of scope 1 emissions.

By identifying the most essential scope 2 emission sources, the company can develop its energy consumption and procurement in a more sustainable direction and reduce the emissions of its business.

Scope 3: indirect greenhouse emissions of the value chain

Scope 3 emissions cover all indirect greenhouse gas emissions that occur as a result of the company’s operations, but the emission sources are not directly owned or controlled by the company. These emissions include, for example, emissions caused by the supply chain, emissions from transport, emissions from the use of sold products and emissions from waste treatment.

In most companies, the majority of greenhouse gas emissions are generated in the company’s value chain, either upstream or downstream in relation to the company’s own operations.

Upstream emission sources include all indirect emissions that occur in the company’s value chain up to the moment of handing over one’s own product or service.

The GHG protocol divides these emission sources into eight different categories:

- Purchased products and services

- Fixed assets

- Activities related to fuels and energy that have not been taken into account as part of the scope 1 & 2 calculation

- Upstream transportation and distribution

- Handling of waste generated in operations

- Business trips

- Business trips

- Property leased by the company

- Downstream emission sources include all indirect emissions that occur after the product or service is delivered to the customer.

The GHG protocol divides these emission sources into seven different categories:

- Downstream transportation and distribution

- Processing of sold products

- Emissions from the use of sold products

- Emissions from the final processing of sold products

- Downstream leased property

- Franchise Business Emissions

- Emissions from investment activities

Why is monitoring the company’s emissions important?

Carbon footprint monitoring and reporting is an important way for companies to take responsibility for their environmental impact. Since 2014, all companies employing at least 500 people have been obliged to report on their social and environmental impacts in accordance with the European Union’s NFR (Non-Financial Reporting Directive).

With the new CSRD directive, it was intended to expand the scope of the corporate reporting guidelines and more uniform reporting standards. In addition, the reporting obligation will gradually extend to all listed companies.

Scope 1, 2 and 3 emissions included in responsibility reporting

In the EU, various directives oblige companies to report on the environmental harm and social impact of their business operations.

Since 2014, the European Union’s NFR Directive (Non-Financial Reporting Directive) has obliged all companies employing more than 500 people to report on their social and environmental impacts. This obligation also applies to the reporting of greenhouse gas emissions.

From 2024, the reporting obligation according to the new CSRD (Corporate Sustainability Reporting Directive) will enter into force, and with it, reporting will move to an approach in accordance with the new guidelines.

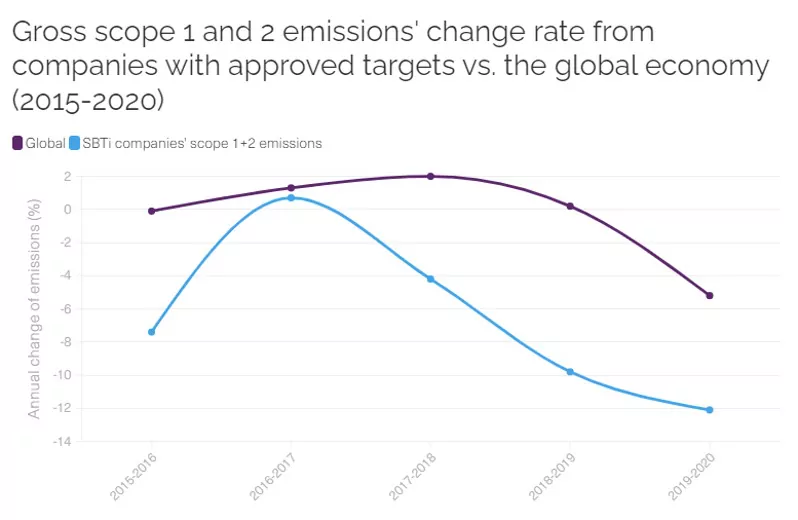

The CSRD directive aims to expand the scope of reporting and establish more uniform reporting standards. CSRD requires companies to ensure that the company’s operations are in line with the goals of the Paris Climate Agreement. Meeting this requirement requires companies to monitor greenhouse gas emissions even more closely and to achieve ambitious and goal-oriented emission reductions.

Management of climate effects particularly responsible business activities

Finding out the sources of greenhouse gas emissions that are relevant to the company’s operations and calculating the emissions is the first step in managing the company’s climate impacts. By identifying the most significant emission sources, the company can set appropriate and effective emission reduction targets for its own operations.

Timely and targeted measures make it possible to reduce emissions in the company’s business in the short and long term. In the future, it will no longer be enough to manage the emissions of one’s own operations (scope 1&2), but it is also necessary to apply emission reduction measures to the emissions of the value chain (scope 3).

It is important to include the management and planned reduction of climate impacts as part of the company’s responsibility strategy, because the company’s climate responsibility is an inseparable part of sustainable business operations. The stricter requirements and expectations of stakeholders and legislation regarding responsibility require ambitious and effective climate measures.

Although not all small and medium-sized companies are necessarily under the same pressure in terms of emission reductions, the emission reduction measures and targets of large companies trickle down the value chain to smaller companies as well. For this reason, it is also time for SMEs to include climate issues as part of their responsibility strategy and to prepare well in advance for possible future claims.

Ecobio’s team of experts are happy to help you with all questions related to greenhouse gases and their monitoring and reporting.

Submit your question via the form below and we’ll get back to you shortly.

Katrine Hoset

Katrine Hoset Sanna Perkiö

Sanna Perkiö Malena Weuerlander

Malena Weuerlander